Road tax rates will increase on 1 April, 2026. Here we look at the full list of how much your VED will be for the 26/27 tax year.

Motoring journalist and expert Pete Barden reveals how drivers face

across-the-board rises from April 2026. The standard VED rate increases from £195 to £200, while

first-year charges jump by £5 to £200 higher, depending on emissions.

For example, cars emitting

151–170g/km see a £50 hike from £1,360 to £1,410, and the top band leaps £100 from £5,490 to £5,690.

Scroll on to see how much you'll be hit on April 1.

See below for new car tax charges and changes for 2026/27, along with what you'll be paying until April 1, 2026.

Most drivers will need VED for their

vehicles and it will be going up again on 1 April 2024 - find out the details here (Credit:

Pixabay)

Most drivers will need VED for their

vehicles and it will be going up again on 1 April 2024 - find out the details here (Credit:

Pixabay)

-

TABLE OF CONTENTS

-

New VED (road tax) rates from April 1 2026

-

Current VED road tax rates - valid until March 31, 2026

-

How is the annual increase in VED Road Tax decided?

-

Does the road tax rate rise apply to diesel and petrol cars?

-

How much car tax will I have to pay this year?

-

How do I find out my car's emissions to see what band it is in?

-

Do I have to pay road tax for my car?

-

What tax band is my car in by reg?

-

What tax band is a new unregistered car in? How to find out

-

Do you pay road tax on electric cars?

-

Electric car road tax VED rates from April 2025

-

Check if road tax is valid on car now

Full list of VED rates from April 1, 2026

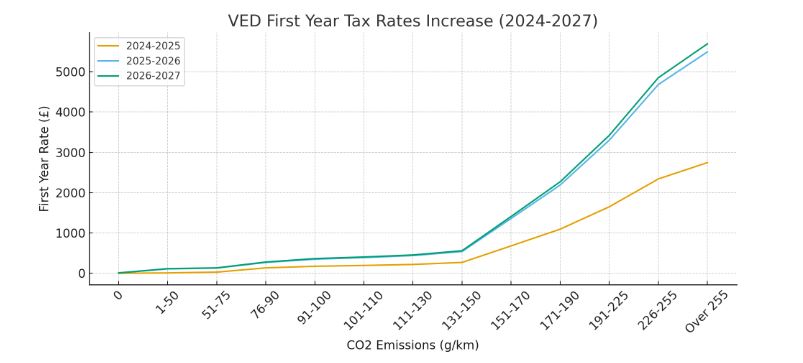

The full list of how much VED road tax you'll be paying for your car, van or motorcycle is now in. Use the following tables to see how much the tax has gone up for your vehicle. (The following table shows the rate of increase for first-year VED 2024-2027)

Electric car and hybrid owners won't have to pay the new pay-per-mile tax until April 2028 - it's explained here.

NEW VED ROAD TAX CHARGES FROM APRIL 1, 2026 - APRIL 1, 2027

Vehicle Excise Duty (VED) bands and rates for cars first registered on or after 1 April 2017

The changes to VED rates to take effect from 1 April 2026 are set out in the following tables.

Tax year 2026 to 2027

| CO2 emissions (g/km) | Standard rate | First year rate |

|---|---|---|

| 0 | 200 | 10 |

| 1 to 50 | 200 | 115 |

| 51 to 75 | 200 | 135 |

| 76 to 90 | 200 | 280 |

| 91 to 100 | 200 | 365 |

| 101 to 110 | 200 | 405 |

| 111 to 130 | 200 | 455 |

| 131 to 150 | 200 | 560 |

| 151 to 170 | 200 | 1,410 |

| 171 to 190 | 200 | 2,270 |

| 191 to 225 | 200 | 3,420 |

| 226 to 255 | 200 | 4,850 |

| Over 255 | 200 | 5,690 |

Vehicle Excise Duty bands and rates for cars first registered on or after 1 March 2001

Tax year 2026 to 2027

| Vehicle Excise Duty band | CO2 emissions (g/km) | Standard rate |

|---|---|---|

| A | Up to 100 | 20 |

| B | 101 to 110 | 20 |

| C | 111 to 120 | 35 |

| D | 121 to 130 | 170 |

| E | 131 to 140 | 200 |

| F | 141 to 150 | 225 |

| G | 151 to 165 | 275 |

| H | 166 to 175 | 325 |

| I | 176 to 185 | 360 |

| J | 186 to 200 | 410 |

| K | 201 to 225 | 445 |

| L | 226 to 255 | 760 |

| M | Over 255 | 790 |

Band K includes cars emitting over 225g/km registered before 23 March 2006.

Vehicle Excise Duty bands and rates for cars and vans registered before 1 March 2001

| Engine size | Tax year 2024 to 2025 | Tax year 2025 to 2026 | Tax year 2026 to 2027 |

|---|---|---|---|

| 1549cc and below | 210 | 220 | 230 |

| Above 1549cc | 345 | 360 | 375 |

Vehicle Excise Duty bands and rates for vans registered on or after 1 March 2001

| Vehicle registration date | Tax year 2024 to 2025 | Tax year 2025 to 2026 | Tax year 2026 to 2027 |

|---|---|---|---|

| Early Euro 4 and Euro 5 compliant vans | 140 | 140 | 140 |

| All other vans | 335 | 345 | 360 |

Vehicle Excise Duty bands and rates for motorcycles

| Engine Size | Tax year 2024 to 2025 | Tax year 2025 to 2026 | Tax year 2026 to 2027 |

|---|---|---|---|

| Not over 150cc | 25 | 26 | 27 |

| 151cc to 400cc | 55 | 57 | 59 |

| 401cc to 600cc | 84 | 87 | 90 |

| Over 600cc | 117 | 121 | 125 |

Vehicle Excise Duty bands and rates for motor tricycles

| Engine Size | Tax year 2024 to 2025 | Tax year 2025 to 2026 | Tax year 2026 to 2027 |

|---|---|---|---|

| Not over 150cc | 25 | 26 | 27 |

| All other tricycles | 117 | 121 | 125 |

Vehicle Excise Duty bands and rates for trade licences

| Vehicle type | Tax year 2024 to 2025 | Tax year 2025 to 2026 | Tax year 2026 to 2027 |

|---|---|---|---|

| Available for all vehicles | 165 | 171 | 177 |

| Available only for bicycle sand tricycles (weighing no more than 450kg without a sidecar) | 117 | 121 | 125 |

Vehicle Excise Duty Expensive Car Supplement threshold from April 1 2026

The Chancellor has also confirmed the Vehicle Excise Duty Expensive Car Supplement threshold will increase to £50,000 for zero-emission vehicles only, for vehicles registered from 1 April 2025 onwards.

The current £40,000 supplement will remain frozen for traditionally powered new cars being registered on or after 1 April 2025.

What’s changing for 'expensive' EVs and why you should wait to buy

-

Now (2025/26): Any new car with a list price over £40,000 pays the Expensive Car Supplement (ECS) from year 2 to year 6 (currently £425 per year, rising to £440 in 2026/27).

-

From 1 April 2026: The threshold rises to £50,000 — but only for zero-emission cars (EVs).

-

Petrol, diesel and hybrid cars stay on the £40,000 threshold.

This means EVs priced between £40,000 and £50,000 will no longer pay the supplement if registered from April 2026.

EVs moving OUT of the Expensive Car Supplement bracket

| Model | Typical UK List Price | ECS Under Current £40k Rule? | ECS From 1 April 2026 (£50k EV Rule)? |

|---|---|---|---|

| Tesla Model Y (RWD / Long Range) | £41k–£49k | Yes | No |

| Tesla Model 3 (Long Range) | £44k–£49k | Yes | No |

| Hyundai Ioniq 5 (higher trims) | £41k–£48k | Yes | No |

| Kia EV6 (Air / GT-Line) | £43k–£49k | Yes | No |

| Volkswagen ID.4 (higher trims) | £41k–£48k | Yes | No |

| Skoda Enyaq (higher trims) | £41k–£47k | Yes | No |

| Ford Mustang Mach-E (Select / Premium RWD) | £44k–£49k | Yes | No |

| Cupra Tavascan (base trim) | £47k–£49k | Yes | No |

What this means for buyers

-

Buying one of these EVs before April 2026 = likely to pay the ECS for five years (years 2–6).

-

Registering the same car from April 1 2026 onwards = no expensive car supplement if it remains under £50,000.

-

Higher-spec EVs above £50,000 will still pay the supplement.

-

Petrol, diesel and hybrid models above £40,000 continue to pay it regardless of the date.

CURRENT VED ROAD TAX CHARGES

The following information covers the period from April 1, 2025 to March 31, 2026

Road tax (VED) from April 1, 2025 - bad news for hybrid owners

Starting from April 1, 2025, the UK's Vehicle Excise Duty (VED) rates for new cars are set for a major overhaul, with significant increases in first-year rates for certain vehicle emissions categories. The government explains these changes as a way to "strengthen incentives" for choosing zero-emission and electric vehicles by expanding the cost differences between electric, hybrid, and internal combustion engine (ICE) vehicles.

How much more you'll be paying at a glance

The full figures are below, but here is a quick overview of all the price rises you'll need to soak up from April 2025 (see above for potential VED rates from April 1 2026) - along with all the other hikes coming your way from Broadband to water bills.

From April 1, 2025, UK drivers will face higher Vehicle Excise Duty (VED) costs.

Electric vehicle owners will start paying £195 annually, while petrol and diesel car owners will see standard rates rise from £165 to £195.

First-year rates for new cars will double for many bands, with vehicles emitting over 255g/km of CO₂ paying £5,490, up from £2,745.

Hybrid cars will also see a £30 increase.

Additionally, the luxury car supplement for vehicles over £40,000 will rise to £425 per year for five years. These changes are part of the government's strategy to update road tax policies.

VED (road tax) rates from April 1, 2025

Here is how much VED road tax will be charged from April 1, 2025 after the Autumn Budget 30 October, 2024.

Look out for a huge rise paid for those driving fully-electric and hybrid vehicles.

| CO2 emissions (g/km) | Standard rate | First year rate |

|---|---|---|

| 0 | 195 | 10 |

| 1 to 50 | 195 | 110 |

| 51 to 75 | 195 | 130 |

| 76 to 90 | 195 | 270 |

| 91 to 100 | 195 | 350 |

| 101 to 110 | 195 | 390 |

| 111 to 130 | 195 | 440 |

| 131 to 150 | 195 | 540 |

| 151 to 170 | 195 | 1,360 |

| 171 to 190 | 195 | 2,190 |

| 191 to 225 | 195 | 3,300 |

| 226 to 255 | 195 | 4,680 |

| Over 255 | 195 | 5,490 |

Vehicle Excise Duty bands and rates for cars first registered on or after 1 March 2001

VED road tax for tax year 2025 to 2026

| Vehicle Excise Duty band | CO2 emissions (g/km) | Standard rate |

|---|---|---|

| A | Up to 100 | 20 |

| B | 101 to 110 | 20 |

| C | 111 to 120 | 35 |

| D | 121 to 130 | 165 |

| E | 131 to 140 | 195 |

| F | 141 to 150 | 215 |

| G | 151 to 165 | 265 |

| H | 166 to 175 | 315 |

| I | 176 to 185 | 345 |

| J | 186 to 200 | 395 |

| K | 201 to 225 | 430 |

| L | 226 to 255 | 735 |

| M | Over 255 | 760 |

Band K includes cars emitting over 225g/km registered before 23 March 2006.

Vehicle Excise Duty bands and rates for cars and vans registered before 1 March 2001

| Engine size | Tax year 2023 to 2024 | Tax year 2024 to 2025 | Tax year 2025 to 2026 |

|---|---|---|---|

| 1549cc and below | 200 | 210 | 220 |

| Above 1549cc | 325 | 345 | 360 |

Vehicle Excise Duty bands and rates for vans registered on or after 1 March 2001

| Vehicle registration date | Tax year 2023 to 2024 | Tax year 2024 to 2025 | Tax year 2025 to 2026 |

|---|---|---|---|

| Early Euro 4 and Euro 5 compliant vans | 140 | 140 | 140 |

| All other vans | 320 | 335 | 345 |

Vehicle Excise Duty bands and rates for motorcycles

| Engine Size | Tax year 2023 to 2024 | Tax year 2024 to 2025 | Tax year 2025 to 2026 |

|---|---|---|---|

| Not over 150cc | 24 | 25 | 26 |

| 151cc to 400cc | 52 | 55 | 57 |

| 401cc to 600cc | 80 | 84 | 87 |

| Over 600cc | 111 | 117 | 121 |

VED rates for the previous period 2024/2025

The following are historic rates of VED road tax for comparison.

VED (road tax) rates from April 1, 2024

These are our predicted rates for a sample of VED (road tax) rates from April 1, 2024, based on RPI increases. These could change if policy changes or additional tariffs are added.

Vehicle Excise Duty (VED) bands and rates for cars first registered on or after 1 April 2017 (rates for 2024/25)

| CO2 emissions (g/km) | Standard rate | First year rate |

|---|---|---|

| 0 | 0 | 0 |

| 1 to 50 | 190 | 10 |

| 51 to 75 | 190 | 30 |

| 76 to 90 | 190 | 135 |

| 91 to 100 | 190 | 175 |

| 101 to 110 | 190 | 195 |

| 111 to 130 | 190 | 220 |

| 131 to 150 | 190 | 270 |

| 151 to 170 | 190 | 680 |

| 171 to 190 | 190 | 1,095 |

| 191 to 225 | 190 | 1,650 |

| 226 to 255 | 190 | 2,340 |

| Over 255 | 190 | 2,745 |

(source Gov.uk)

Vehicle Excise Duty bands and rates for cars first registered on or after 1 March 2001 (rates for 2024/25)

| Vehicle Excise Duty band | CO2 emissions (g/km) | Standard rate |

|---|---|---|

| A | Up to 100 | 0 |

| B | 101 to 110 | 20 |

| C | 111 to 120 | 35 |

| D | 121 to 130 | 160 |

| E | 131 to 140 | 190 |

| F | 141 to 150 | 210 |

| G | 151 to 165 | 255 |

| H | 166 to 175 | 305 |

| I | 176 to 185 | 335 |

| J | 186 to 200 | 385 |

| K | 201 to 225 | 415 |

| L | 226 to 255 | 710 |

| M | Over 255 | 735 |

Band K includes cars emitting over 225g/km registered before 23 March 2006.

Vehicle Excise Duty bands and rates for cars and vans registered before 1 March 2001 (new rates for 2024/25)

| Engine size | Tax year 2022 to 2023 | Tax year 2023 to 2024 | Tax year 2024 to 2025 |

|---|---|---|---|

| 1549cc and below | 180 | 200 | 210 |

| Above 1549cc | 295 | 325 | 345 |

Vehicle Excise Duty bands and rates for vans registered on or after 1 March 2001 (rates for 2024/25)

| Vehicle registration date | Tax year 2022 to 2023 | Tax year 2023 to 2024 | Tax year 2024 to 2025 |

|---|---|---|---|

| Early Euro 4 and Euro 5 compliant vans | 140 | 140 | 140 |

| All other vans | 290 | 320 | 335 |

Vehicle Excise Duty bands and rates for motorcycles (rates for 2024/25)

| Engine Size | Tax year 2022 to 2023 | Tax year 2023 to 2024 | Tax year 2024 to 2025 |

|---|---|---|---|

| Not over 150cc | 22 | 24 | 25 |

| 151cc to 400cc | 47 | 52 | 55 |

| 401cc to 600cc | 73 | 80 | 84 |

| Over 600cc | 101 | 111 | 117 |

Vehicle Excise Duty bands and rates for motor tricycles (rates for 2024/25)

| Engine Size | Tax year 2022 to 2023 | Tax year 2023 to 2024 | Tax year 2024 to 2025 |

|---|---|---|---|

| Not over 150cc | 22 | 24 | 25 |

| All other tricycles | 101 | 111 | 117 |

Company car tax — all cars

| CO2 emissions, g/km | Electric range (miles) | Appropriate percentage (%) for 2024 to 2025 | Appropriate percentage (%) for 2025 to 2026 | Appropriate percentage (%) for 2026 to 2027 | Appropriate percentage (%) for 2027 to 2028 | Appropriate percentage (%) for 2028 to 2029 | Appropriate percentage (%) for 2029 to 2030 |

|---|---|---|---|---|---|---|---|

| 0 | Not applicable | 2 | 3 | 4 | 5 | 7 | 9 |

| 1 to 50 | More than 130 | 2 | 3 | 4 | 5 | 18 | 19 |

| 1 to 50 | 70 to 129 | 5 | 6 | 7 | 8 | 18 | 19 |

| 1 to 50 | 40 to 69 | 8 | 9 | 10 | 11 | 18 | 19 |

| 1 to 50 | 30 to 39 | 12 | 13 | 14 | 15 | 18 | 19 |

| 1 to 50 | Less than 30 | 14 | 15 | 16 | 17 | 18 | 19 |

| 51 to 54 | — | 15 | 16 | 17 | 18 | 19 | 20 |

| 55 to 59 | — | 16 | 17 | 18 | 19 | 20 | 21 |

| 60 to 64 | — | 17 | 18 | 19 | 20 | 21 | 22 |

| 65 to 69 | — | 18 | 19 | 20 | 21 | 22 | 23 |

| 70 to 74 | — | 19 | 20 | 21 | 21 | 22 | 23 |

| 75 to 79 | — | 20 | 21 | 21 | 21 | 22 | 23 |

| 80 to 84 | — | 21 | 22 | 22 | 22 | 23 | 24 |

| 85 to 89 | — | 22 | 23 | 23 | 23 | 24 | 25 |

| 90 to 94 | — | 23 | 24 | 24 | 24 | 25 | 26 |

| 95 to 99 | — | 24 | 25 | 25 | 25 | 26 | 27 |

| 100 to 104 | — | 25 | 26 | 26 | 26 | 27 | 28 |

| 105 to 109 | — | 26 | 27 | 27 | 27 | 28 | 29 |

| 110 to 114 | — | 27 | 28 | 28 | 28 | 29 | 30 |

| 115 to 119 | — | 28 | 29 | 29 | 29 | 30 | 31 |

| 120 to 124 | — | 29 | 30 | 30 | 30 | 31 | 32 |

| 125 to 129 | — | 30 | 31 | 31 | 31 | 32 | 33 |

| 130 to 134 | — | 31 | 32 | 32 | 32 | 33 | 34 |

| 135 to 139 | — | 32 | 33 | 33 | 33 | 34 | 35 |

| 140 to 144 | — | 33 | 34 | 34 | 34 | 35 | 36 |

| 145 to 149 | — | 34 | 35 | 35 | 35 | 36 | 37 |

| 150 to 154 | — | 35 | 36 | 36 | 36 | 37 | 38 |

| 155 to 159 | — | 36 | 37 | 37 | 37 | 38 | 39 |

| 160 and over | — | 37 | 37 | 37 | 37 | 38 | 39 |

New car tax (vehicle excise rates, VED) 1 April, 2023 - 31 March, 2024

In his Spring Budget back in March, Chancellor Jeremy Hunt confirmed an increase in VED rates for cars, vans and motorcycles in line with RPI from 1 April 2023. However, to help support the haulage sector, VED for HGVs will remain frozen for 2023-24.

Standard road tax (VED) from 1 April, 2023 - 31 March, 2024

The vehicle excise duty increased by RPI, which is 10.1%, and is rounded to the nearest £1 or £5. Standard rate road tax (VED) has increased from £165 to £180.00.

First-year and 'luxury' car tax from 1 April, 2023 - 31 March, 2024

Does the road tax rate rise apply to diesel and petrol cars?

Yes. The RPI-related hike to VED has been applied to both petrol and diesel vehicles since 1 April 2022.

How much car tax will I have to pay?

The amount of road tax that you will have to pay depends entirely on how ‘green’ your car is – judged by the CO2 emissions that it pumps out of the exhaust pipe. See the bands below to match your car to a band.

How do I find out my car's emissions to see what band it is in?

There are various methods, but an easy way is to check online using this Gov.UK tool to find your car's emissions.

Subscribe for free updates on road tax rises and other motoring news

Road tax (Vehicle Excise Duty) charges from 1 April, 2023 - 31 March, 2024

These are the new road tax (VED) prices you will be asked to pay for 2023/2024.

Cars first registered on or after April 1 2017: First year road tax rates and standard VED from 1 April 2023 - 31 March 2024

Your vehicle emits 0g/km:

You will pay £0 for the first-year rate

Your vehicle emits 1-50g/km:

First-year road tax rates will remain at £10

Standard VED rate increases from £165 to £180

Your vehicle emits 51-75g/km:

First-year road tax will remain at £30

Standard VED rate increases from £165 to £180

Your vehicle emits 76-90g/km:

First-year road tax rates will increase from £120 - £130

Standard VED rate increases from £165 to £180

Your vehicle emits 91-100g/km:

First-year road tax rates will increase from £150 to £165

Standard VED rate increases from £165 to £180

Your vehicle emits 101-110g/km:

First-year road tax rates will increase from £170 to £185

Standard VED rate increases from £165 to £180

Your vehicle emits 111-130g/km:

First-year road tax rates will increase from £190 to £210

Standard VED rate increases from £165 to £180

Your vehicle emits 131-150g/km:

First-year road tax rates will increase from £230 to £255

Standard VED rate increases from £165 to £180

Your vehicle emits 151-170g/km:

First-year road tax rates will increase from £585 to £645

Standard VED rate increases from £165 to £180

Your vehicle emits 171-190g/km:

First-year road tax rates will increase from £945 to £1,040

Standard VED rate increases from £165 to £180

Your vehicle emits 191-225g/km:

First-year road tax rates will increase from £1,420 to £1,565

Standard VED rate increases from £165 to £180

Your vehicle emits 226-255g/km:

First-year road tax rates will increase from £2,015 to £2,220

Standard VED rate increases from £165 to £180

Your vehicle emits over 255g/km:

The first-year rate for these vehicles will increase from £2,365 to £2,605

Standard VED rate increases from £165 to £180

Cars first registered on or after March 1 2001 - 31 March 2017

Band A: VED will remain the same at 0.

Band B: Standard rate will remain the same at £20.

Band C: Standard rate will remain the same at £35.

Band D: Standard rate £150.

Band E: Standard rate £180.

Band F: Standard rate £200.

Band G: Standard rate £240.

Band H: Standard rate £290.

Band I: Standard rate £320.

Band J: Standard rate £365.

Band K: Standard rate £395.

Band L: Standard rate £675.

Band M: Standard rate £695.

How much is the £40,000-plus car tax surcharge (1 April, 2023 - 31 March, 2024)

This is a VED surcharge that must be paid on cars that cost more than £40,000 when new. It was previously set at £335 but subsequently increased to £390 on 1 April 2023.

This surcharge must be paid each year on top of the standard flat rate of VED. Owners will need to pay it for five years from the second year of registration. When the car reached six years old, it falls back to the standard flat rate. It’s worth noting that zero-emission cars do not pay this charge.

Most read motoring content

Take a look at more of our top motoring-related content here...

-

How does freezing weather impact diesel cars - risking breakdowns?

-

My driving licence has expired - can I keep driving while I wait for a new one?

-

Here's why you urgently need to protect your EV from mice

-

The most popular car colours - revealed

-

Most congested roads in the UK revealed - is your route on the list?

-

Most congested roads in the UK revealed - is your route on the list?

-

Can you park on the pavement where you live?

-

Do you have to tell the DVLA about floaters in your eyes?

-

Can you ride an electric bike if banned from driving?

-

What is the most popular electric car (EV) for UK buyers 2022?

-

Secret parking offences you're committing but don't realise

-

Are my sunglasses legal for driving - how to check instantly?

-

How old is a car by its number plate? Full list

-

Will I always get a speeding ticket after being flashed?

-

Will I get a speed awareness course instead of points?

-

Do I need an international driving permit for France, Spain, Greece and other EU countries

-

What are the rules around double white lines and the risk of £1,000 fine?

-

Do I pay the Birmingham Clean Air Zone at weekends?

-

What does my driving licence number reveal about me - and why it should never be shared online

-

How to spot a fake undercover police car

-

Do I need an electric car licence and driving test in the UK?

-

Can I vape in a car with kids in it?

-

Can I book cancelled driving tests to beat the rush?

-

When can I apply for a provisional licence?

-

Are electric scooters legal in the UK now? When is the law changing?

-

Can I drive in sliders in the UK?

-

What are the black dots on my windscreen for?

-

How can I find out who owns a car

-

Electric car charging points at UK airports for public use - 2022

-

How old are my tyres - find out instantly here

-

What happens to a car when the owner dies?

-

How far and how fast can I drive on a space saver spare wheel

-

Can I be fined if the car park ticket machine is not working?

-

Is the M6 Toll Road free in the evening and at weekends?

-

How much is the Tamar Bridge toll and when do I need to pay it?

Do I have to pay road tax?

On the whole, yes, but there are a few exceptions that could mean you – or more importantly your vehicle – are exempt from paying vehicle excise duty. These include the following:

- Your new car has zero CO2 emission from the tailpipe and comes with a list price of less than £40,000.

- Your car is more than 40 years old. If you own a vehicle that was registered before 1 January 1983 then it will likely be exempt from paying road tax. You must confirm this with the DVLA. Additionally, if you do not know when your vehicle was built, but it was first registered before 8 January 1983, you can also apply to stop paying vehicle tax. If your vehicle is exempt, you will need to apply to have the exemption made official and not just assume you can drive without letting the DVLA know. You can apply for exemption here.

- Some drivers with disabilities can also register as being exempt from paying VED. More information can be found here on road tax exemption for drivers with disabilities.

What tax band is my car in by reg?

You may not be able to find the tax band of your car just by its registration number, but you can find out the exact amount of tax you will need to pay for a vehicle by entering the 11-digit reference number found on its V5C log book. Simply get the V5C reference number and enter it to the this Gov.UK page to get the exact amount of road tax you will pay - and how much annual, six-monthly, or monthly charges for VED will be.

What tax band is a new unregistered car in? How to find out

The Government has a tool that can help you find out what tax band your existing car or a new vehicle is in. The tool is free to use and can be accessed 24 hours a day for ease of information. Use this tool here to find out what tax band a car is in and how much it will cost at the time of checking.

Do you pay road tax on electric cars?

While road tax, or as it is officially known as VED, or vehicle excise duty is paid on all conventional cars - and hybrid cars now - fully electric cars are currently exempt from paying any road tax at all.

However, Chancellor Jeremy Hunt has already confirmed that electric car owners will have to pay road tax - or Vehicle Excise Duty (VED) as it is officially known - from April 2025.

Chancellor Hunt justified the new tax by saying: "Because the OBR (Office for Budget Responsibility) forecast half of all new vehicles will be electric by 2025, to make our motoring tax system fairer I've decided that from then, electric vehicles will no longer be exempt from vehicle excise duty."

Business car tax rates will also get a discount for those using electric vehicles.

Currently, zero-emissions vehicles do not have to pay the £165 standard rate of road tax or the £335 supplement that cars costing more than £40,000 are charged, but with the huge increase in such cars being purchased, the chancellor will be aware of Treasury predictions the drivers turning to electric cars could cost £7billion in lost tax revenues.

Electric car road tax VED rates from April 2025

- new zero emission cars registered on or after 1 April 2025 will be liable to pay the lowest first year rate of VED (which applies to vehicles with CO2 emissions 1 to 50g/km) currently £10 a year. From the second year of registration onwards, they will move to the standard rate, currently £165 a year

- zero emission cars first registered between 1 April 2017 and 31 March 2025 will also pay the standard rate

- the Expensive Car Supplement exemption for electric vehicles is due to end in 2025. New zero emission cars registered on or after 1 April 2025 will therefore be liable for the expensive car supplement. The Expensive Car Supplement currently applies to cars with a list price exceeding £40,000 for 5 years

- zero and low emission cars first registered between 1 March 2001 and 30 March 2017 currently in Band A will move to the Band B rate, currently £20 a year

- zero emission vans will move to the rate for petrol and diesel light goods vehicles, currently £290 a year for most vans

- zero emission motorcycles and tricycles will move to the rate for the smallest engine size, currently £22 a year

- rates for Alternative Fuel Vehicles and hybrids will also be equalised

Car tax bands 2023/24 at-a-glance guide to your road tax (historic rates)

Here is a quick reference set of tables to show how much car tax you are likely to be paying in 2023/24 after 1 April whatever you are driving.

CO2 emissions |

First Year Rate from 1 April 23 |

Std Rate from 1 April 2023 |

| 0 g/km | £0 | £0 |

| 1 to 50 g/km | £10 | £180 |

| 51 to 75 g/km | £30 | £180 |

| 76 to 90 g/km | £130 | £180 |

| 91 to 100 g/km | £165 | £180 |

| 101 too 110 g/km | £185 | £180 |

| 111 to 130 g/km | £210 | £180 |

| 131 to 150 g/km | £255 | £180 |

| 151 to 170 g/km | £645 | £180 |

| 171 to 190 g/km | £1,040 | £180 |

| 191 to 225 g/km | £1,565 | £180 |

| 226 to 255 g/km | £2,220 | £180 |

| Over 255 g/km | £2,605 | £180 |

Vehicle Excise Duty bands and rates for cars and vans registered before 1 March 2001

| Engine size | Tax year 2022 to 2023 | Tax year 2023 to 2024 |

|---|---|---|

| 1549cc and below | 180 | 200 |

| Above 1549cc | 295 | 325 |

Vehicle Excise Duty bands and rates for vans registered on or after 1 March 2001

| Vehicle registration date | Tax year 2022 to 2023 | Tax year 2023 to 2024 |

|---|---|---|

| Early Euro 4 and Euro 5 compliant vans | 140 | 140 |

| All other vans | 290 | 320 |

Vehicle Excise Duty bands and rates for motorcycles

| Engine size | Tax year 2022 to 2023 | Tax year 2023 to 2024 |

|---|---|---|

| Not over 150cc | 22 | 24 |

| 151cc and 400cc | 47 | 52 |

| 401cc to 600c | 73 | 80 |

| Over 600cc | 101 | 111 |

How can I pay less for my car tax?

Many people pay for their car tax in monthly instalments across the year, but using this method can mean you pay more. Taking a one-off hit of paying the full annual amount will mean you pay less as car tax rates increase for 2022/23.

Paying for your car tax (VED) monthly or every six months attracts a surcharge of 5%. So, for example, if your vehicle emits 131-150g/km you will pay an extra £11.50 a year for first-year tax with instalments compared to a yearly payment, or an extra £118.25 for vehicles emitting over 255g/km (these are based on 2022/23 figures).

What pre-March 2017 cars will get free road tax?

If you want to cut your motoring costs in 2023/24, buying a pre-March 2017 car with emissions less than 100g/km will attract zero road tax. This will include the likes of the Peugeot 107 will qualify for zero road tax and also ensure you’re not hit by taxes such as the ULEZ and other schemes across the UK. You can pick up a decent car that emits less than 100g/km for around £1,500. Have a search now.

Check if road tax is valid on a car now

Now that vehicles do not need to display a tax disc, drivers can find out if their vehicle is currently taxed by using a free online check provided by the government. Check if your vehicle is taxed here.

Will Benefit in Kind rates also be going up for company car drivers?

Company car tax — all cars

| CO2 emissions, g/km | Electric range (miles) | Appropriate percentage (%) for 2022 to 2023 | Appropriate percentage (%) for 2023 to 2024 | Appropriate percentage (%) for 2024 to 2025 | Appropriate percentage (%) for 2025 to 2026 | Appropriate percentage (%) for 2026 to 2027 | Appropriate percentage (%) for 2027 to 2028 |

|---|---|---|---|---|---|---|---|

| 0 | Not applicable | 2 | 2 | 2 | 3 | 4 | 5 |

| 1 to 50 | More than 130 | 2 | 2 | 2 | 3 | 4 | 5 |

| 1 to 50 | 70 to 129 | 5 | 5 | 5 | 6 | 7 | 8 |

| 1 to 50 | 40 to 69 | 8 | 8 | 8 | 9 | 10 | 11 |

| 1 to 50 | 30 to 39 | 12 | 12 | 12 | 9 | 10 | 11 |

| 1 to 50 | Less than 30 | 14 | 14 | 14 | 15 | 16 | 17 |

| 51 to 54 | - | 15 | 15 | 15 | 16 | 17 | 18 |

| 55 to 59 | - | 16 | 16 | 16 | 17 | 18 | 19 |

| 60 to 64 | - | 17 | 17 | 17 | 18 | 19 | 20 |

| 65 to 69 | - | 18 | 18 | 18 | 19 | 20 | 21 |

| 70 to 74 | - | 19 | 19 | 19 | 20 | 21 | 21 |

| 75 to 79 | - | 20 | 20 | 20 | 21 | 21 | 21 |

| 80 to 84 | - | 21 | 21 | 21 | 22 | 22 | 22 |

| 85 to 89 | - | 22 | 22 | 22 | 23 | 23 | 23 |

| 90 to 94 | - | 23 | 23 | 23 | 24 | 24 | 24 |

| 95 to 99 | - | 24 | 24 | 24 | 25 | 25 | 25 |

| 100 to 104 | - | 25 | 25 | 25 | 26 | 26 | 26 |

| 105 to 109 | - | 26 | 26 | 26 | 27 | 27 | 27 |

| 110 to 114 | - | 27 | 27 | 27 | 28 | 28 | 28 |

| 115 to 119 | - | 28 | 28 | 28 | 29 | 29 | 29 |

| 120 to 124 | - | 29 | 29 | 29 | 30 | 30 | 30 |

| 125 to 129 | - | 30 | 30 | 30 | 31 | 31 | 31 |

| 130 to 134 | - | 31 | 31 | 31 | 32 | 32 | 32 |

| 135 to 139 | - | 32 | 32 | 32 | 33 | 33 | 33 |

| 140 to 144 | - | 33 | 33 | 33 | 34 | 34 | 34 |

| 145 to 149 | - | 34 | 34 | 34 | 35 | 35 | 35 |

| 150 to 154 | - | 35 | 35 | 35 | 36 | 36 | 36 |

| 155 to 159 | - | 36 | 36 | 36 | 37 | 37 | 37 |

| 160 and over | - | 37 | 37 | 37 | 37 |

How can I get a road tax refund?

Remember, you cannot sell a car with road tax, so you will need to get a refund on the remaining months if you do not want to lose the money. Here is our easy-to-follow guide to get your road tax refund.

I don't drive my car - do I have to pay road tax?

If you never drive your car and you have a private driveway or other non-public space to store it, you do not need to pay road tax on the vehicle. However, it must not be used on a public road or space at all. Additionally, you will need to let the DVLA know that this is the case by obtaining a Statutory Off-Road Notification - aka a SORN. You can apply for a SORN here.

How is the annual increase in VED Road Tax decided?

The Chancellor combines various elements from inflation to roads policy and vehicle emissions when deciding how much to increase the amount drivers pay for VED - or road tax as most know it. Here are some of the considerations that apply.

-

Vehicle Emissions: VED rates in the UK are often linked to a vehicle's CO2 emissions. Vehicles emitting lower levels of CO2 are placed in lower tax bands, while those with higher emissions face higher tax rates. The goal is to incentivise the use of vehicles with lower environmental impact.

-

Inflation: VED rates can be subject to periodic adjustments to account for inflation. The rates may increase in line with the Retail Price Index (RPI) to maintain their real value over time.

-

Budgetary Considerations: Changes to VED rates can be influenced by the government's broader budgetary needs and priorities. Adjustments may be made to generate additional revenue or to align with the government's fiscal policies.

-

Public Policy Goals: VED rates are often used to support broader public policy objectives, such as reducing air pollution and promoting the adoption of greener vehicles. The government may adjust rates to encourage the purchase of electric or low-emission vehicles.

-

Vehicle Type: The type of vehicle, including fuel type and whether it's a private car or a commercial vehicle, can impact the VED rate.

-

Government Announcements: Changes to VED rates are typically announced as part of the annual budget speech delivered by the Chancellor of the Exchequer. The proposed changes would then be subject to parliamentary approval.

Author: Pete Barden:

Twitter: @pete_barden

Pete Barden is a qualified journalist who has written and produced for publications including The Sun (thesun.co.uk), New Statesman Media Group, Whatcar? (Whatcar.com) Stuff Magazine (Stuff.tv), Fastcar Magazine (Fastcar.co.uk), Maxim Magazine and UK broadcast stations within the Heart network (Formerly GCAP). Pete specialises in motoring and travel content, along with news and production roles. You can find out more about Pete Barden on LinkedIn.

About us: Pete Barden Motoring and Travel News

See our privacy page here

We strive to ensure the information on this page is accurate at time of writing but cannot be held responsible for errors or omissions.